Which Best Describes Job Cost Record

A denominator used by management. It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job.

This Free Job Cost Record Template Used To Accumulate Costs Of Direct Materials Di Project Management Templates Bookkeeping Templates Job Description Template

The total of the Job Cost expense account in the general ledger c.

. It is used by management to understand how direct costs affect profitability. It is used by management to understand how direct costs affect profitability. It is used by management to understand how direct costs affect profitabi d.

Which one of the following best describes a job cost sheet. Manufacturing or production order. Examine personnel records for accuracy and completeness.

Job costing involves the accumulation of the costs of materials labor and overhead for a specific job. Numbers 4 and 8 in the diagram represents A prepare a cheque and extract a Trial balance B extract a trial balance and prepare final reports. How do you record the sale of land.

The actual costs of a job typically include the following items. Which one of the following best describes a job cost sheet. It is used to track manufacturing overhead costs to specific jobs.

25 Questions Show answers. It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job. Since there is a significant variation in the items manufactured the job order costing system requires a separate job cost record for each item or each job or special order.

It is used to track manufacturing overhead costs to specific jobs. Which one of the following describes an activity base. An alternative use is to see if any excess costs incurred can be billed to a customer.

The diagram below refers to item 8. In job costing a cost sheet is often used to record costs incurred in stages of production. The cost sheet and job order work may also be combined when costs are recorded.

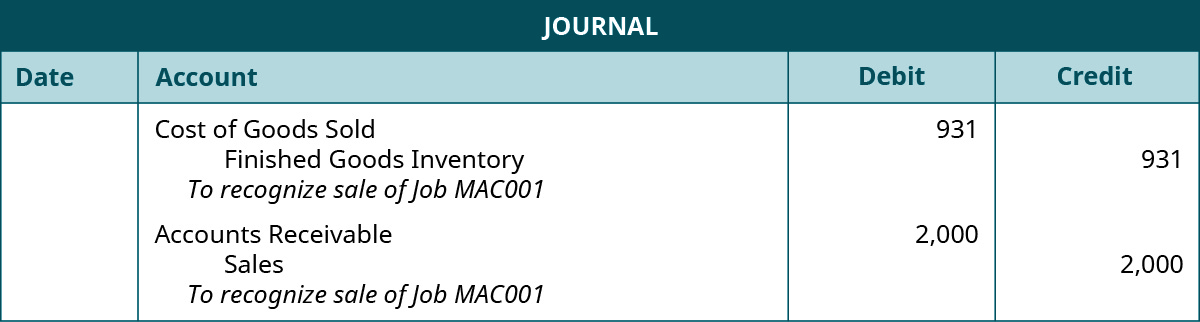

Why isnt a key employee reported as an asset on the balance sheet. It is used to track manufacturing overhead costs to specific jobs. Debit Cost of Goods Sold 7000 and credit Finished Goods Inventory 7000.

The accounting department is responsible to record all manufacturing costs direct materials direct labor and manufacturing overhead on the job cost sheet. The sheet is usually completed after a job has been closed though it can be compiled on a concurrent basis. A job cost record forms part of a job cost system and is used to accumulate manufacturing costs of direct materials direct labor and applied overhead for a particular job.

The sales and profit of a firm for the year 2016 are Rs150000 and Rs20000 and for the year 2017 are Rs170000 and Rs25000 respectively. The job cost record will report each items direct materials and direct labor that were actually used and an assigned amount of manufacturing overhead. Which one of the following best describes a job cost sheet.

Jim found a job with a take-home pay of 950 per month. For example a ship builder would likely. Answer - 8550 units.

The report is compiled by the accounting department and distributed to the management team to see if a job was correctly bid. Mynex Company completes Job No. What is the entry to remove equipment that is sold before it is fully depreciated.

Which group of players provides all goods and services in the game of economics. The job cost records also serve as the. Medium Which of the following is the best way for an auditor to determine that every name on a companys payroll is that of a bona fide employee presently on the job.

Group of answer choices. It is a form used to record the costs chargeable to a specific job and to de total and unit costs of the completed job. Debit Finished Goods Inventory 7000 and credit Work in Process Inventory 7000 B.

He must pay 400 for rent and 100 for groceries each month. A separate job cost. A correct entry is.

A job cost sheet is a compilation of the actual costs of a job. A Source document which authorizes issuance of raw materials to production B Measures records and reports product costs C It is used by management to understand how direct costs affect profitability D It is used to track manufacturing overhead costs to specific jobs. Up to 24 cash back 7.

It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job. The job cost records. Job cost sheet is a document used to record manufacturing costs and is prepared by companies that use job-order costing system to compute and allocate costs to products and services.

He also spends 100 per month on transportation. Which one of the following best describes a job cost sheet. This approach is an excellent tool for tracing specific costs to individual jobs and examining them to see if the costs can be reduced in later jobs.

Job costing also called job order costing is best suited to those situations where goods and services are produced upon receipt of a customer order according to customer specifications or in separate batches. A subsidiary account for recording the materials used on each job. It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job an activity that has a direct cause-effect relationship with the resources consumed is an.

Direct materials and direct labor are actual values taken from material requisitions documents and time sheets. The cost of all job costs incurred during the year. Job cost record definition.

What is another name for the stores ledger cards. The source document used to record the amount of time worked by an employee on a job is called the. Examine employees names listed on payroll tax returns for agreement with payroll accounting records.

5 Which one of the following best describes a job cost sheet. Which one of the following best describes a job cost sheet. The PV Ratio of the firm is.

26 at a cost of 4500 and later sells it for 7000 cash. See job order cost sheet. In each of the separate job cost records.

Debit Finished Goods Inventory 4500 and credit Work in Process Inventory. Applied overhead is allocated to the job on a predetermined basis eg. Request form for getting the necessary materials from the materials store room.

This document authorizes the manufacturing or production department to produce a specified quantity of a product which constitutes the job. One of the detailed rules used to record business transaction is A Objectivity B Accruals C Double entry book keeping DGoing Concern 8.

Which One Of The Following Best Describes A Job Cost Sheet In 2022 Cost Sheet Job Sheet

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

Job Cost Report Template Excel 9 Templates Example Templates Example Report Template Estimate Template Spreadsheet Template

No comments for "Which Best Describes Job Cost Record"

Post a Comment